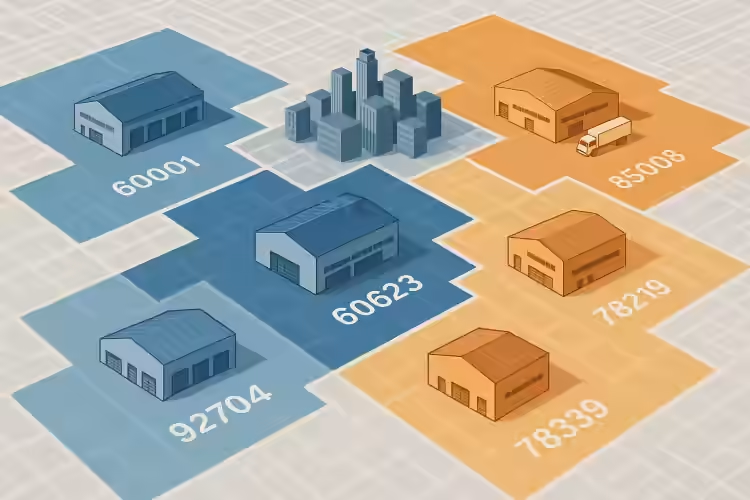

How Lease Rates Vary by ZIP Code

Why ZIP Codes Matter in Industrial Leasing

You’d think square footage is square footage, right? Not quite.

In the world of industrial leasing, where your building sits—down to the ZIP code—can swing your lease rate by double digits. It’s not just about *state* or *metro area* anymore. It’s about pinpoint geography.

Want proof? A 50,000 sq ft warehouse in ZIP 90220 (Compton, California) might cost twice as much as a comparable space 30 miles east in ZIP 92337 (Fontana).

That’s not a glitch—it’s how the market works.

So what drives this ZIP-by-ZIP variance?

Urban vs. Suburban vs. Rural ZIPs

Let’s break it down with a simple analogy: Think of ZIP codes like hotel rooms. A room overlooking Times Square costs more than one in the Catskills. Why? Demand, accessibility, and utility.

Same with warehouses.

- Urban ZIPs: Expect the highest premiums. These are your last-mile hubs, close to end consumers. Limited space + high demand = $$$.

- Suburban ZIPs: Often strike a balance. More space, still solid access, and lower rents. Think sweet-spot for regional fulfillment.

- Rural ZIPs: Cheapest per sq ft. But also the furthest from customers. Good for bulk storage, not so much for quick turnarounds.

The Last-Mile Premium: ZIP Codes That Command Top Dollar

If your operation relies on lightning-fast delivery, you’re gonna pay for it. The “last-mile premium” is real—and you’ll see it baked right into ZIP-level lease comps.

Some ZIPs are just hot. Not because the buildings are prettier, but because the location hits all the right notes:

- Within 10 miles of a major downtown

- Minutes from a freeway junction

- Near population density *and* affluent consumer bases

- In Miami, ZIP 33166 (Doral area) can easily push $18–$22 per sq ft. Ten years ago? Half that.

- In New York City, ZIP 11232 (Sunset Park in Brooklyn) sees rates above $30/sq ft for modern industrial. Thirty bucks. For a warehouse.

You’re paying to be close. That proximity lets e-commerce, food, pharma, and logistics companies slash delivery times—and justify the rent.

Case Study: Los Angeles vs. Inland Empire

This one’s a textbook example of ZIP-code-driven rate divergence.

Los Angeles ZIPs (90021, 90220)

- Proximity to Port of LA/Long Beach

- Dense customer base

- Last-mile delivery goldmine

- Average lease rate: $19–$25/sq ft

Inland Empire ZIPs (92337, 92571)

- Same metro area, but 40+ miles inland

- Massive supply of logistics-ready warehouses

- Cheaper land, lower operating costs

- Average lease rate: $6–$8/sq ft

Companies often split the difference. Bulk storage in the Empire, last-mile in LA. Smart setup if you can manage two sites.

How to Compare ZIP Codes Smartly

Not all high-cost ZIPs are "bad deals"—and not all cheap ZIPs are smart wins.

You’ve gotta match location with use-case. Here’s how:

- Need speed? Pay for proximity to your customers or DCs.

- Need volume? Focus on where land and space are abundant.

- Need labor? Cross-check warehouse ZIPs with workforce data.

Tools You Can Use

Want to dig into the ZIP-level data yourself? These tools help:

- LoopNet / CREXi: Great for browsing current listings by ZIP

- CoStar / CompStak: Pro-level tools for historical comps and lease analytics

- CBRE Market Reports: Good overview by metro, often with ZIP breakouts

- Google Maps + Census Tract data: Combine location intelligence with demographics

Closing Thoughts

ZIP codes aren’t just a mailing address—they’re market signals.

A five-digit change can mean a 2x shift in rent, a total pivot in strategy, or a make-or-break in your logistics model. Don’t choose on price alone. Choose on *fit*.

And if you’re unsure? Test a short-term lease in a few ZIPs before making a long-term move. Because when it comes to warehouse real estate, local really is everything.